News

2023: New reporting obligation to all real estate owners

Since January 1, 2023, all owners (individuals and legal persons) of a property built for residential use are affected by a new reporting obligation to the tax authorities. This declaration consists of listing the occupation of the accommodation on January 1, 2023 of...

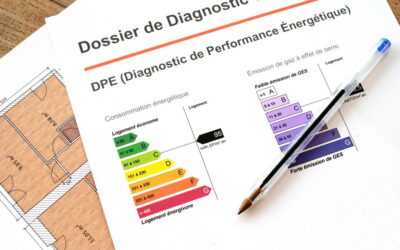

Energy Performance Survey and landlords owning rental accommodation

Since July 1, 2021 and the application of the "climate and resilience" law, the properties Energy Performance Survey has been completely redefined in order to fight against energy sieves (classes F and G of the said survey) taking into account the high nature in their...

NEW PLACE published in the Press

The real estate market is in the spotlight on the front page of the VAR MATIN newspaper this morning. Find the interview with your Team NEW PLACE , which remains mobilized in this period of health crisis to support you throughout your real estate projects.

COVID-19 – Health instructions to our customers

In the fight against COVID-19, your NEW PLACE Agencies welcome you under strict health and safety conditions. Strict application of barrier gestures at all times within our agencies and in external meetings Wearing a mask is MANDATORY in our premises and during...

Inheritance

1) Inheritance french law If there is no will or donation, the law determines the heirs of an inheritance. Each heir has to pay the inheritance tax within 6 months following the death.If the deceased was a resident You are submitting to the inheritance tax on all...

Top 10 things to do to best enjoy Port Grimaud

Pittoresque and charming city whose architecture is so special and out of norm dating from 1966, that worth the detour… Take a boat ride Inside the marina, enjoy a superb experience while navigating into the canals: a pleasant 30 minute or 20 minute ride is possible...

Top dreams cities where to install your vacation home

GRIMAUD, the municipality which reaches the top the TOP 10 list with its notorious lake city of PORT GRIMAUD By Olivier Marin, published on July 11th, 2019 in FIGARO Properties Source...

Local taxes and real estate incomes

The two taxes, the housing tax and the property tax, are quite distinct, but both are paid to the benefit of the communes. Council tax Collected for local authorities, this tax is imposed on the occupier of a property (main or secondary house) on January 1st of each...

The Real Esate Capital Gain

The Real Estate Capital Gain is the positive difference between the purchase price and the resale price of a property. The tax payable on the Real Estate capital gain is the one that you must pay when the sale price is higher than the purchase price when acquiring the...

Grimaud and Port Grimaud, exceptional micro-markets

Playing host to the up-market estates of Beauvallon and Guerrevieille, as well as the famous "lagoon city" of Port Grimaud, Grimaud benefits from an untarnished reputation thanks, in particular, to its exemplary management and ideal location on the Gulf of...

My Favorites

My Favorites