New Place acts as a real estate consultant. We answer all your questions related to real estate investment as well as more specific questions such as the donation of property. Our agents are experts in negotiation but also in real estate taxation.

If you wish to donate your house or apartment located in France to your relatives, we do explain you the procedure, the ins and outs of the process in our Port Grimaud agencies.

What is a « Donation »?

The French Civil Code defines and regulates the law of donation.

It is a notarial act which include two persons: the donor and the donee.

The donor transfers his property to the person of his choice, called the donee.

Therefore, the donor makes possible the acquisition of a property by his donation.

The real estate donation includes properties such as houses, apartments, and grounds that are regulated and framed by the applicable French law.

The conditions of a Donation

Some conditions have to be respected by the donor and the donee to make possible a donation:

- The donor, has to be sane, has to be above 16 years old, and be able legally to dispose of the property.

- The donee, has to accept the donation. The acceptation is express and not tacit.

If the donor disposes reserved heirs, the donation is limited in this case. If some descendants or a spouse exist, the donor could only give freely the available quotiety.

The heirs could be able to question the donation if it is above of the donor’s available quotiety. (Cf. article 912 of Civil French Code). The whole property of the donor could be given by donation to the donee of his choice in case of this one has no heirs.

The steps for a Donation

The formalization of the donation can be proceeded in 2 ways: the simple non-formal declaration or the notarial act.

Note: All the donations do not have payments obligations, which is called “payments of donation rights”.

Depending on whether the donation is made between spouses, or children, the cost will be different according to the relationship.

This particular part of the French fiscality is similar to the one that is applicable to the successions.

In fact, the individual beneficiary of a donation must pay certain rights related to the gift received by the donor.

A discount on the value of a property can eventually being reduced to get some “rights of donation” with a tax relief.

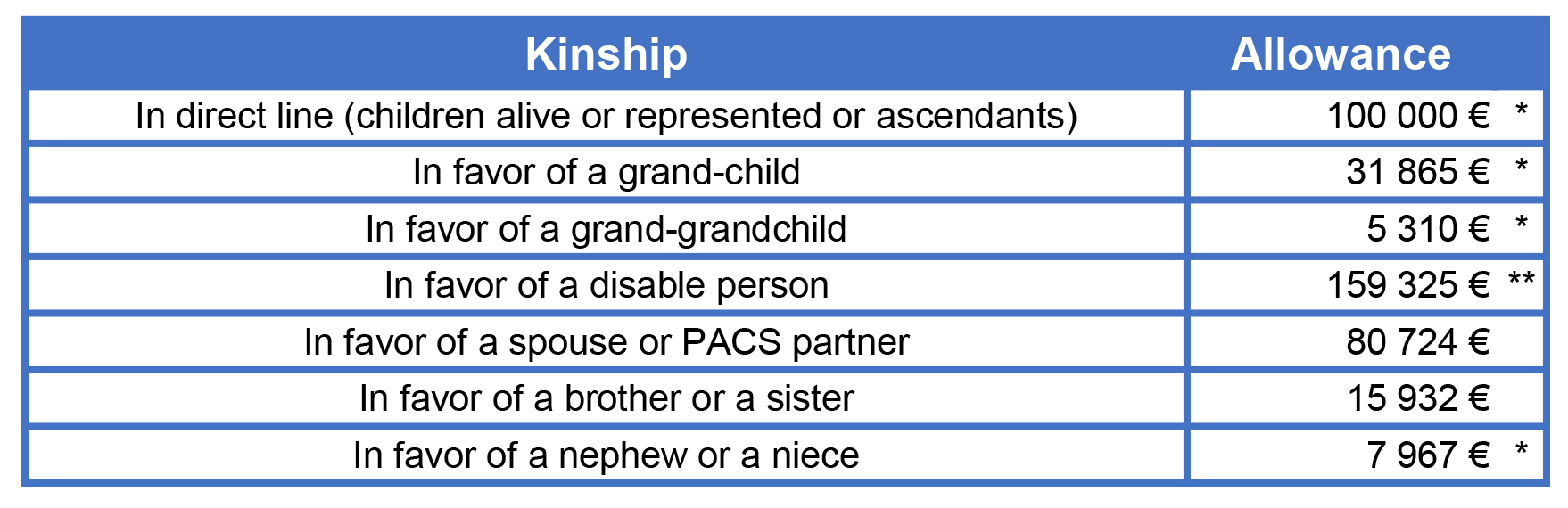

All depends of the relationship between the donor and the donee. The kinship relationship or quality of the beneficiary of the donation.

The allowances applicable to the Donation

* possible accumulation with the family donation of exempt sums of money.

** possible cumulation with all other allowances.

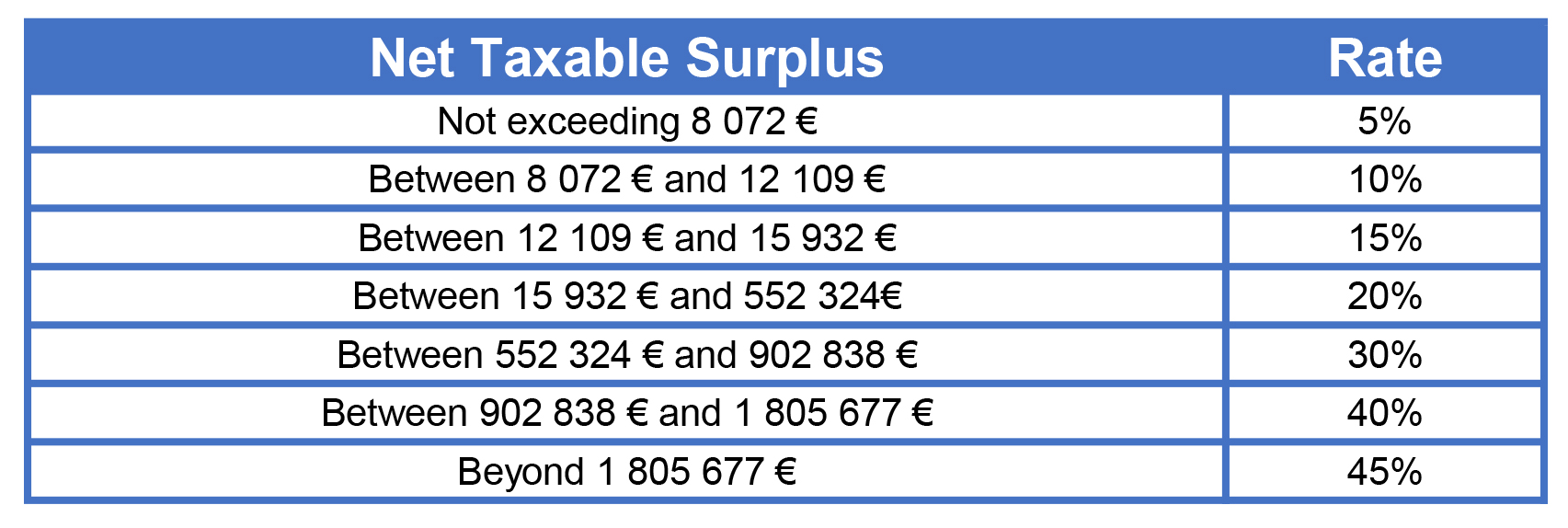

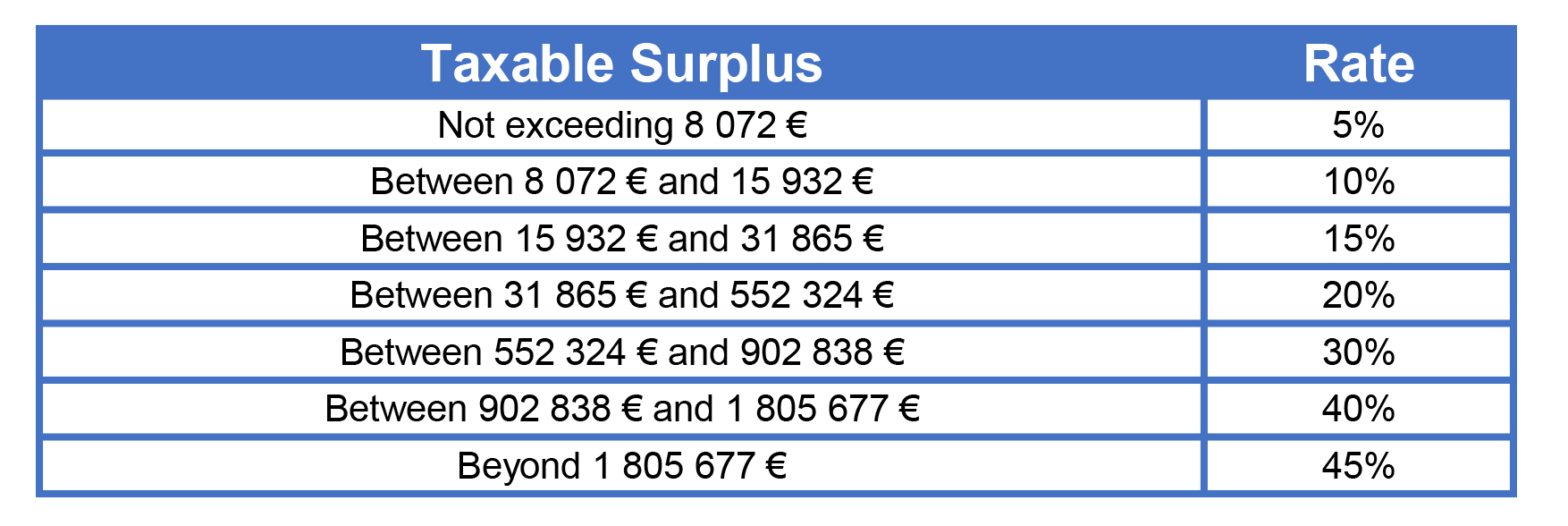

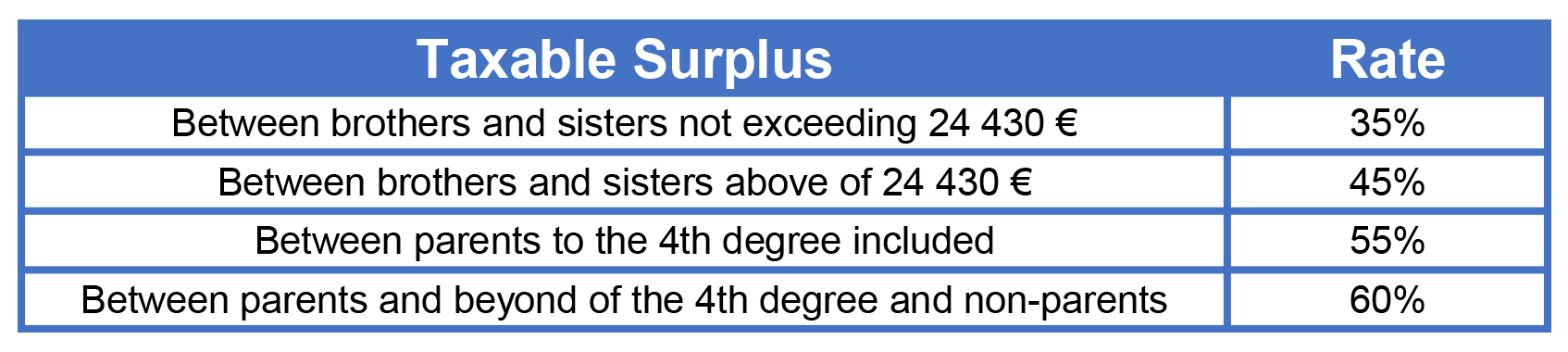

The tax scale of Donations

- Direct line Donation

- Spouse and PACS partners Donation

- Non-kinship and Collateral line’s Donation

My Favorites

My Favorites